US private commercial real estate (CRE) debt is a large and growing asset class that we believe can add value to a multi-asset portfolio. In addition to the potential historical strategic asset allocation benefits, there are three tactical perspectives we have observed in the current market that are referred to as a wall of demand. These are occurring around yield and spreads, reduced cyclical risks, and an expanding opportunity, all of which will be explained in more detail in this article.

For insurance investors, in our opinion, we believe private CRE debt may offer benefits for general account portfolios. These include the potential for enhanced returns at lower risk levels than core bonds, an income-oriented return stream, diversification benefits evidenced by correlations to core bonds, and a dedicated allocation away from public or private corporate credit to which insurers typically have sizable allocations.

US CRE Debt Market

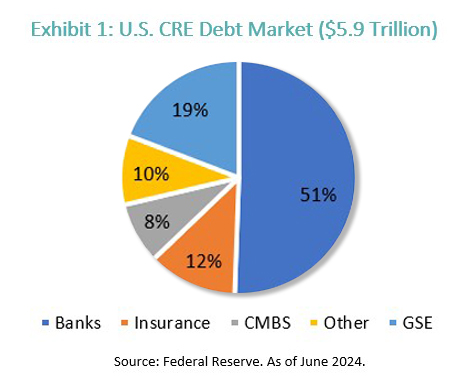

Outstanding US CRE debt, which includes multifamily loans, totaled $5.9 trillion in the second quarter of 2024. These totals represent a little more than half the size of the $11 trillion corporate bond market, which has increased 81%—or 6.1% annually—over the past decade. (See Exhibit 1)

Outstanding US CRE debt, which includes multifamily loans, totaled $5.9 trillion in the second quarter of 2024. These totals represent a little more than half the size of the $11 trillion corporate bond market, which has increased 81%—or 6.1% annually—over the past decade. (See Exhibit 1)

Strategic Considerations

Private CRE debt is diverse but focusing on the core market, it has historically delivered notable portfolio benefits, namely income, competitive risk-adjusted returns, and diversification. In our view, these factors may warrant an examination of this asset class, irrespective of cyclical considerations.

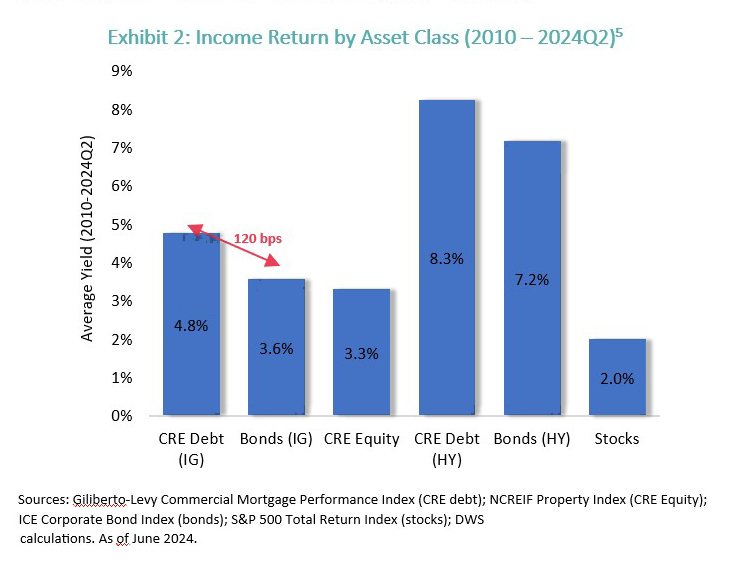

Income Returns: As a credit instrument, private CRE debt has perhaps unsurprisingly delivered stronger income returns than equity investment that offer the potential for earnings-driven capital gains—including stocks and private CRE—since 2010 (see Exhibit 2). More interesting is that its yield has compared favorably with those of corporate bonds, providing a premium of 120 basis points for investment-grade assets. To be sure, the risks associated with CRE debt are different from those of corporate credit. However, we believe that much of the differential represents compensation for the relative complexity and illiquidity of private assets.

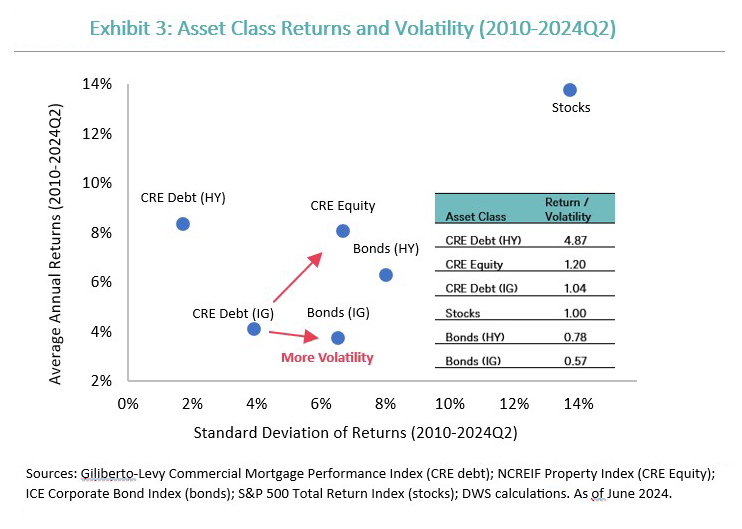

Risk-Adjusted Returns: Private CRE debt has generally delivered lower total returns than equity investments, but has done so with less volatility (see Exhibit 3). Moreover, it has generally achieved higher returns, with lower volatility, than corporate bonds. Unlike equity, it is relatively insulated from the vagaries of earnings expectations (e.g. profit or rent). And as a private asset, we believe that it earns an illiquidity premium, supporting returns. The result: private CRE debt returns have scored well relative to other asset classes on a volatility-adjusted basis.

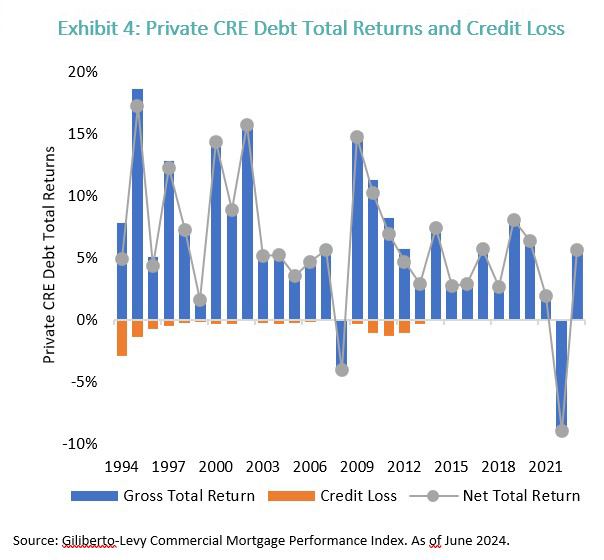

Return volatility aside, risks also appear modest from an underlying credit perspective. Over the past 30 years, credit losses have averaged 30 basis points annually within the Commercial Mortgage Performance Index, a fraction of its 6.3% annualized (gross) return (see Exhibit 4). Banks’ net charge-offs on CRE loans have averaged 20 basis points annually over the same period. Insurance companies, which have typically focused on lower-risk lending, have recorded much lower delinquency rates (averaging 0.4% annually) than banks (2.4%), suggesting, in our view, that credit losses on core loans have also been lower.

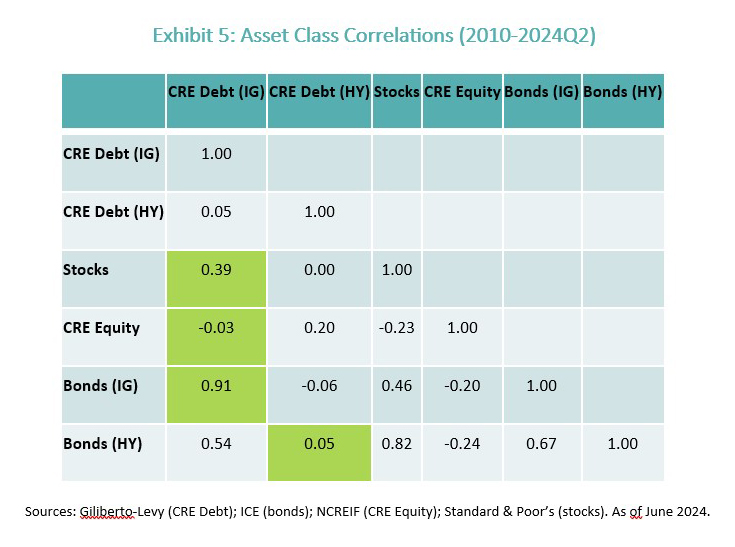

Diversification: Like other fixed income assets, private real estate debt is more sensitive to interest rates than earnings, which creates diversification relative to listed and non-listed equity (see Exhibit 5). Yet unlike other debt, its credit risk is derived from CRE cash flows and collateral, rather than corporate or consumer finances. Coupled with its modest standalone volatility, this implies that private CRE debt may help to reduce overall risk within multi-asset portfolios.

Tactical Considerations

We believe that there are also reasons to consider the asset class from a tactical perspective. These include potentially attractive yields and spreads, reduced cyclical risks, and an expanding opportunity set.

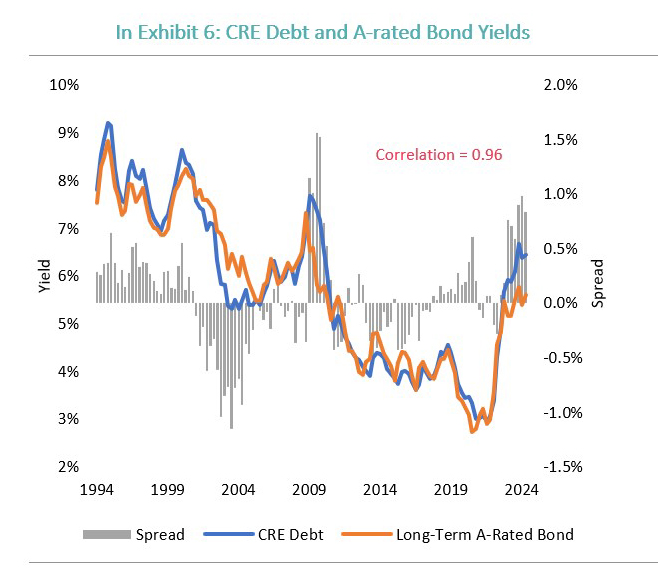

Yield and Spreads. Over the past 30 years, yields on private CRE debt have tracked those on long-term A-rated corporate bonds (See Exhibit 6). In the wake of the Federal Reserve’s 2022-2023 tightening campaign, yields on both instruments rose to their highest level since 2010. However, private CRE lending rates increased further, opening a spread only exceeded during the global financial crisis. In our view, elevated yields and spreads buttress the absolute and relative case for private CRE as a source of income and total return.

Reduced Cyclical Risks: A post-COVID CRE correction has reduced values by 18% and construction starts by 68% (sector-weighted) from their mid-2022 peaks. In our view, stabilizing interest rates, coupled with reduced supply, have laid the foundation for a new real estate cycle, characterized by healthy fundamentals and moderate appreciation. Rising cash flows and values improve borrowers’ capacity to service and repay debts, reducing default risk.

Expanding Opportunity Set: We believe that loan maturities and reviving property sales, amid a pullback from banks, will create lending opportunities over the next several years. Just under half of the $5.9 trillion of outstanding mortgage debt is scheduled to mature through 2028. In some cases, debt may be written off, extended, or replaced with equity, but much of it will require refinancing. Moreover, although property sales volumes were muted through the first half of 2024, we believe that they will pick up as real estate values recover, stimulating demand for new financing.

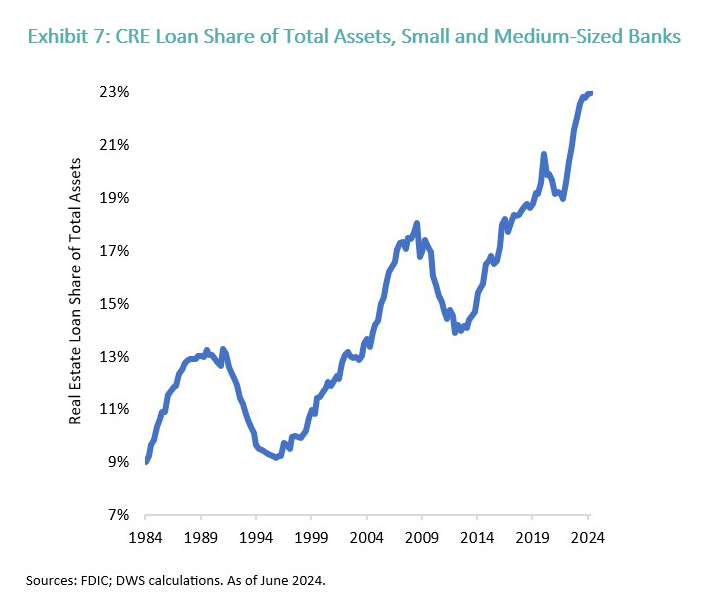

This wall of demand may arrive at a time when banks, which hold 51% of outstanding mortgage debt, are under investor and regulatory pressure to curb their real estate exposure. In particular, small and medium-sized institutions, which account for about 42% of the banking system by 74% of its CRE lending, hold record levels of CRE loans on their balance sheets (see Exhibit 7). We believe that any effort to pare this exposure could create considerable origination and acquisition opportunities for other lenders, on more favorable terms, including yield and credit protections.

Conclusion

From a long-term perspective, private CRE debt has exhibited qualities that may, for many investors, warrant a strategic portfolio allocation. Moreover, current conditions reinforce a case for investing in the asset class, in our view. Yields are elevated, both on an absolute, compared with history, and a relative, compared with other debt instruments, basis.

The prospect of healthy fundamentals and recovering asset values mitigate the credit risks that have already been relatively limited for core loans over the long term. Finally, we believe that debt maturities and a rising pace of transactions, coupled with a pullback from banks, will create abundant opportunities to acquire and originate loans on terms that are favorable for investors.