2021—A Very Good Year

From 2015 to 2020, premium growth for the medical professional liability (MPL) industry chronically lagged that of the total property/casualty (P/C) industry. During this five-year period, direct premiums written (DPW) for the P/C industry increased almost 23%, while premiums for the MPL industry grew less than 7%. This minimal growth in the MPL industry was brought on by a combination of factors including a soft pricing environment that lasted for the better part of a decade, shrinkage in the number of independent physicians that purchase MPL insurance, and a movement towards alternative insurance mechanisms such as captives.

In the first half of 2021, direct premiums written for the MPL industry increased more than 15%. Growth was especially strong in the segments of other facilities (up 31.8%) and other professionals (up 31%), while premiums for physicians and hospitals increased by 13.8% and 4.2%, respectively. This growth was a harbinger of good news for the rest of the year. The MPL industry finished strong in 2021 with premium growth of almost 11%, marking the first time since 2003 the industry recorded double-digit growth (and only the second time since 2006 that growth in the MPL market exceeded that of the total P/C industry).

MPL premium growth in 2021 was driven by several factors, most notably, firmer prices in all sectors of the MPL market, and the gradual return to pre-pandemic levels of healthcare utilization. Further, at the end of 2021, inflation in the consumer price index was running close to 7%—the highest rate of inflation seen since the early 1980s - while nuclear/aberrant verdicts continued to make headlines.

On the surface, this combination of factors might have suggested MPL premiums would continue to grow at a similar pace in 2022. However, there is more to uncover.

Premium Growth Stalls in 2022

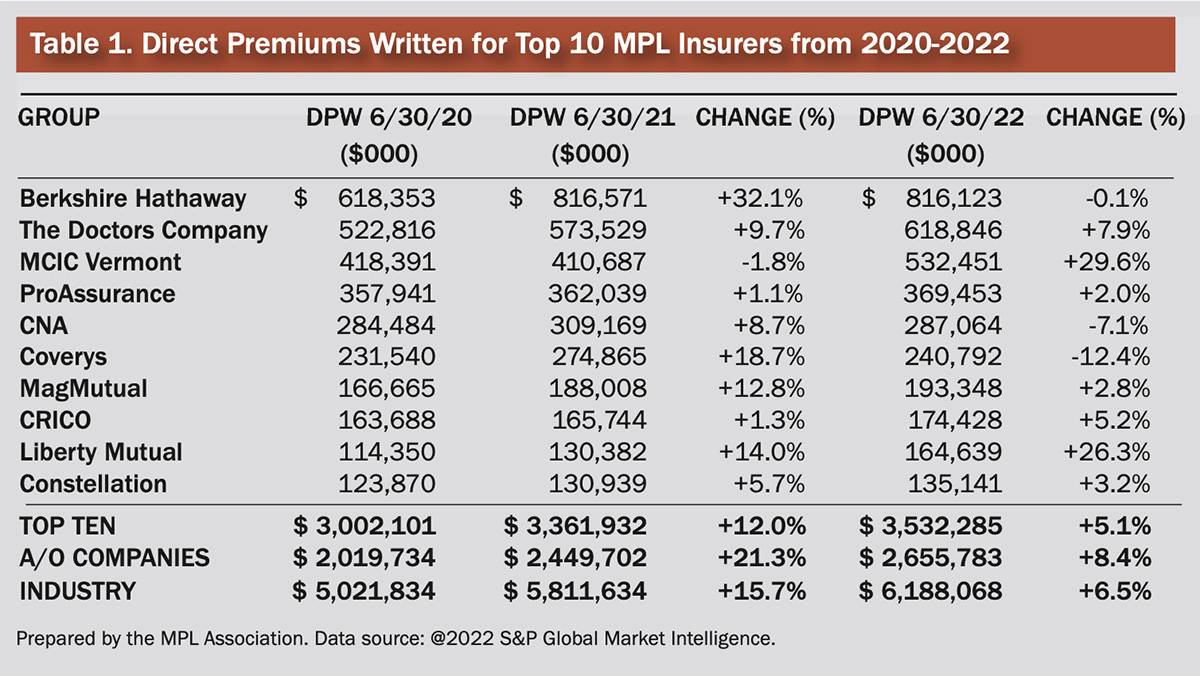

As shown in Table 1, DPW for the MPL industry increased 15.7% in the first six months of 2021. During this period, premiums for the top 10 MPL insurers increased by 12%, with the top insurer, Berkshire Hathaway, showing premium growth of almost $200 million, or 32%. However, in the same six-month period in 2022, premium growth for the industry slowed to 6.5%, while premium growth for the top 10 MPL companies fell to 5.1%. Notably, among the top 10 MPL companies, MCIC Vermont and Liberty Mutual both recorded premium changes in 2022 that were at least 10 percentage points greater than growth in 2021, while Berkshire Hathaway and Coverys recorded premium changes in 2022 that were more than 30 percentage points less than in 2021.

Table 1. Direct premiums written for top 10 MPL Insurers from 2020-2022. Prepared by the MPL Association. Data source: @2022 S&P Global Market Intelligence.

What is happening in 2022? Things were going well through the end of 2021 but through midyear 2022, premium growth appears to have stalled.

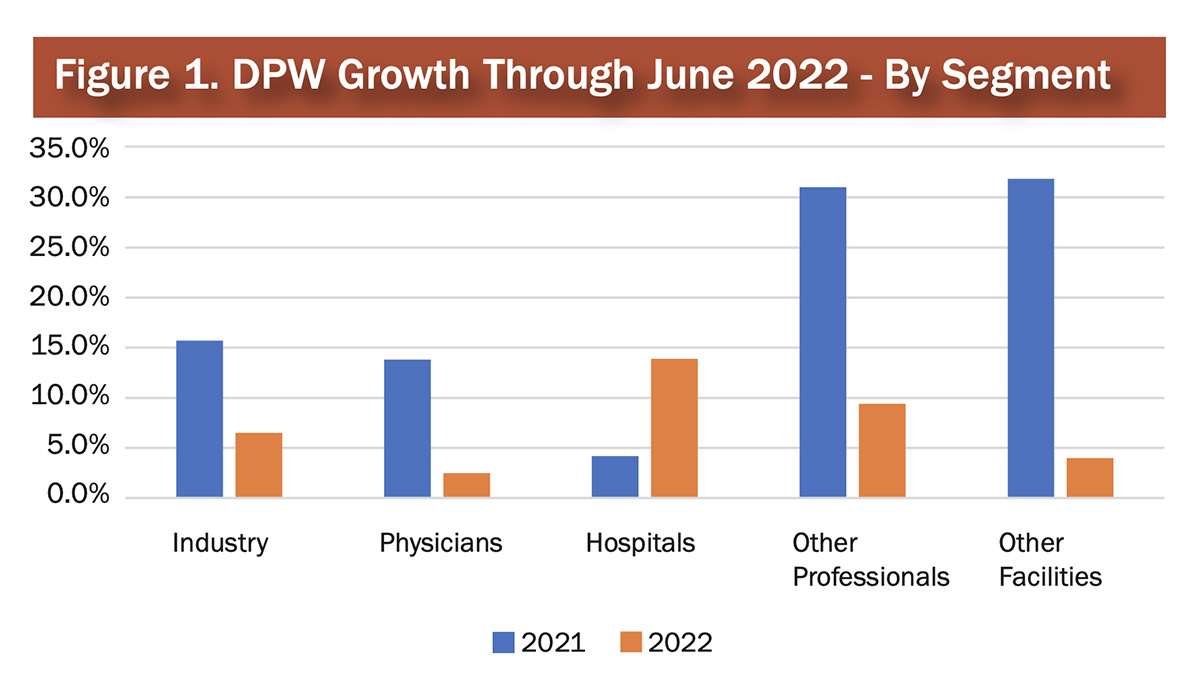

To better understand where growth rates for written premiums are changing and what the driving forces of these changes may be, a deeper analysis of each segment was conducted. Year-over-year—except for hospitals—growth in DPW decreased for the other segments of the market (Figure 1). The decrease was particularly sharp for the other facilities segment, which has been the fastest growing segment of the market.

Figure 1. Direct premium written growth 2021-2022 by segment. Prepared by the MPL Association. Data source: @2022 S&P Global Market Intelligence.

Physicians

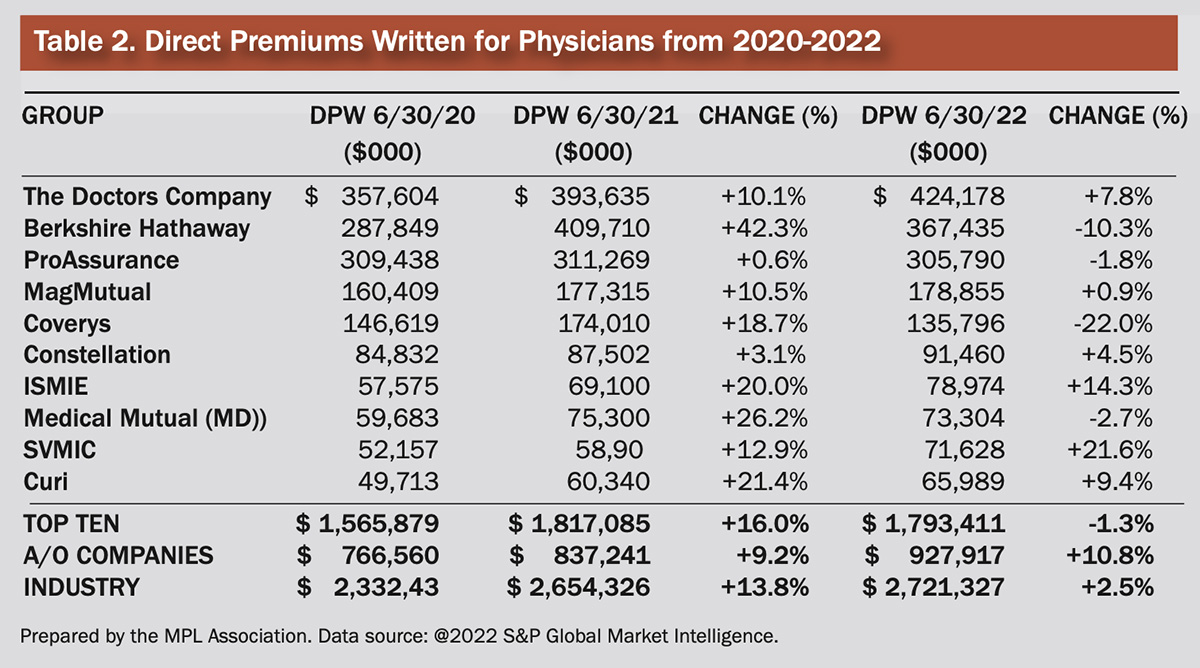

In the first half of 2021, industry written premiums for physicians increased almost 14% while in the same period in 2022, premiums for physicians were up only 2.5% (Table 2). Among the top 10 physician insurers, there was no discernable pattern in the premium growth rates in 2021 and 2022. Most companies show varying degrees of growth in both years, however, several companies showed large growth in 2021 but decreases in 2022.

Table 2. Direct premiums written for physicians from 2020-2022. Prepared by the MPL Association. Data source: @2022 S&P Global Market Intelligence.

Analysis of the companies with near/above-average growth shows these companies typically write business in a limited number of states and have been taking regular rate increases in core states. For companies in the “all other” category, well above-average growth in DPW was observed among risk retention groups. A review of 12 physician-focused risk retention groups (RRGs) showed premium growth of 31%, or almost $48 million, in the first six months of 2022. It is a possibility that the business lost by the companies in the top 10 has migrated to RRGs.

Hospitals

For the last several years, the hospital segment has recorded among the highest loss ratios in the industry. For accident years 2017 to 2021, a representative sample of physician insurers reported an average loss and allocated loss adjustment expense (ALAE) ratio of 78%; over the same period, a representative group of hospital insurers recorded an average loss and ALAE ratio of almost 98%.

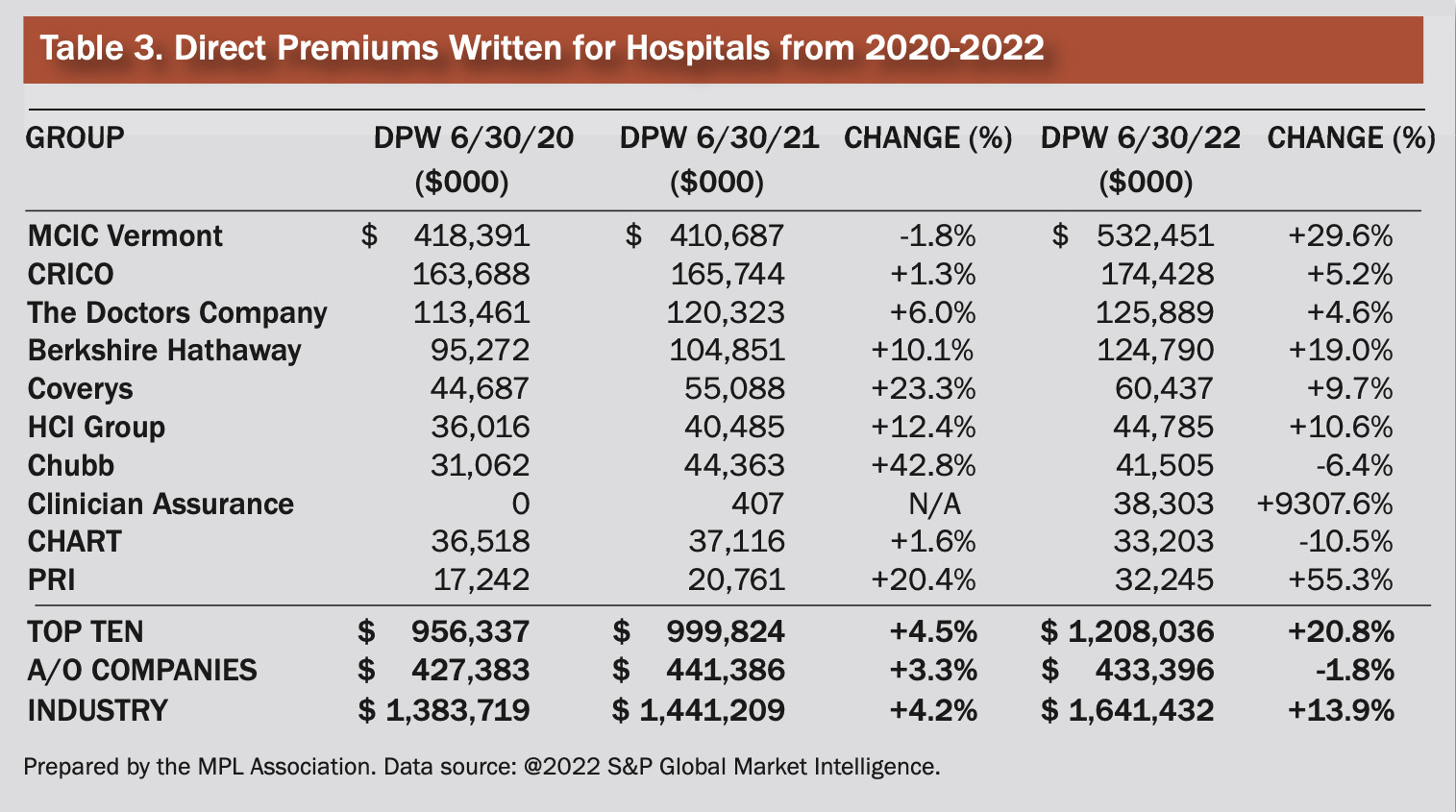

Table 3 shows that DPW for the hospital segment increased by 4.2% from 2020 to 2021 and by 13.9% from 2021 to 2022. However, growth in the hospital segment during the 2021-2022 period was driven largely by MCIC Vermont (where DPW increased 30% in 2022). Excluding MCIC Vermont, DPW for the hospital segment was up 6.8% in 2021, and 7.6% in 2022—consistent (and necessary) premium growth rates for the sector.

Table 3. Direct premiums written for hospitals from 2020-2022. Prepared by the MPL Association. Data source: @2022 S&P Global Market Intelligence.

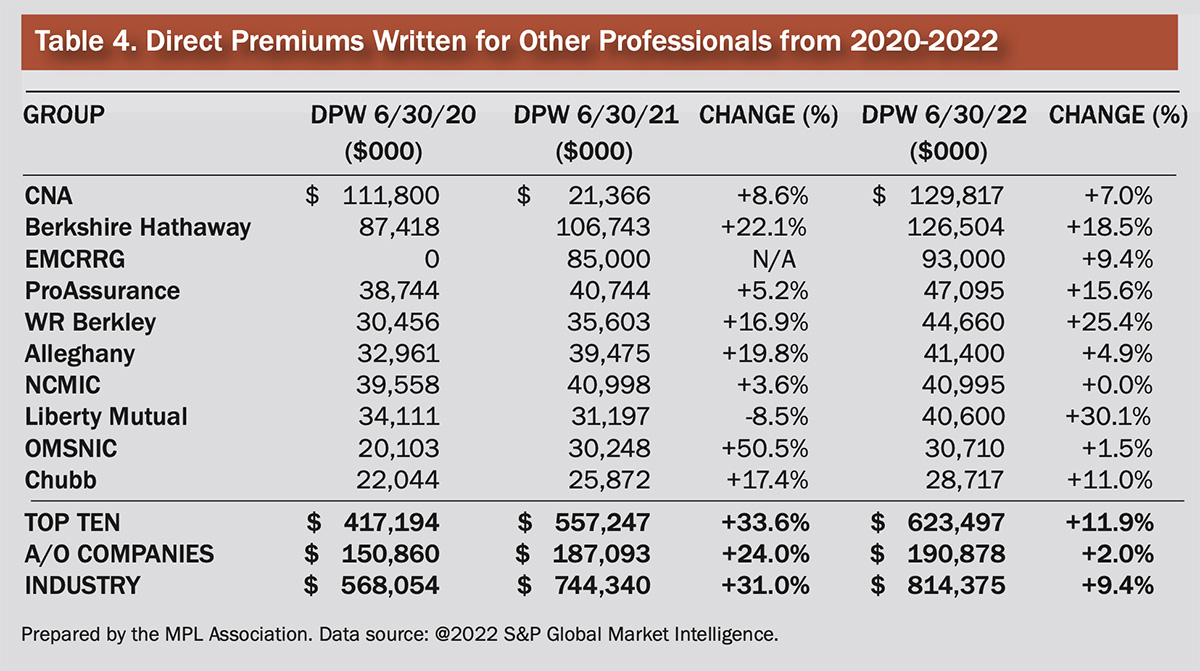

Other Professionals

In the first six months of 2021, DPW for other professionals increased by 31% over the first half of 2020. During this period, almost half of the growth came from Emergency Capital Management RRG (EMCRRG), whose DPW went from zero to $85 million.

ECMRRG had been put into a dormant state in 2017, but effective March 31, 2021, the company reactivated its operations “to provide primary layer [MPL] to [Envision Healthcare] and the physician practice groups it contractually manages across the country”. According to Dun & Bradstreet, Envision Healthcare has 25,000 physicians and advanced practitioners. Therefore, it is unlikely all EMMRRG’s DPW was for “other professionals,” but rather should have been recorded as physicians’ premium. Excluding ECMRRG, DPW for “other professionals” increased by 16.1% from 2020 to 2021, and by 9.4% from 2021 to 2022. These adjusted premium increases likely represent a combination of higher pricing and exposure growth in ancillary professionals including nurse practitioners and physician assistants.

Table 4. Direct premiums written for other professionals from 2020-2022. Prepared by the MPL Association. Data source: @2022 S&P Global Market Intelligence.

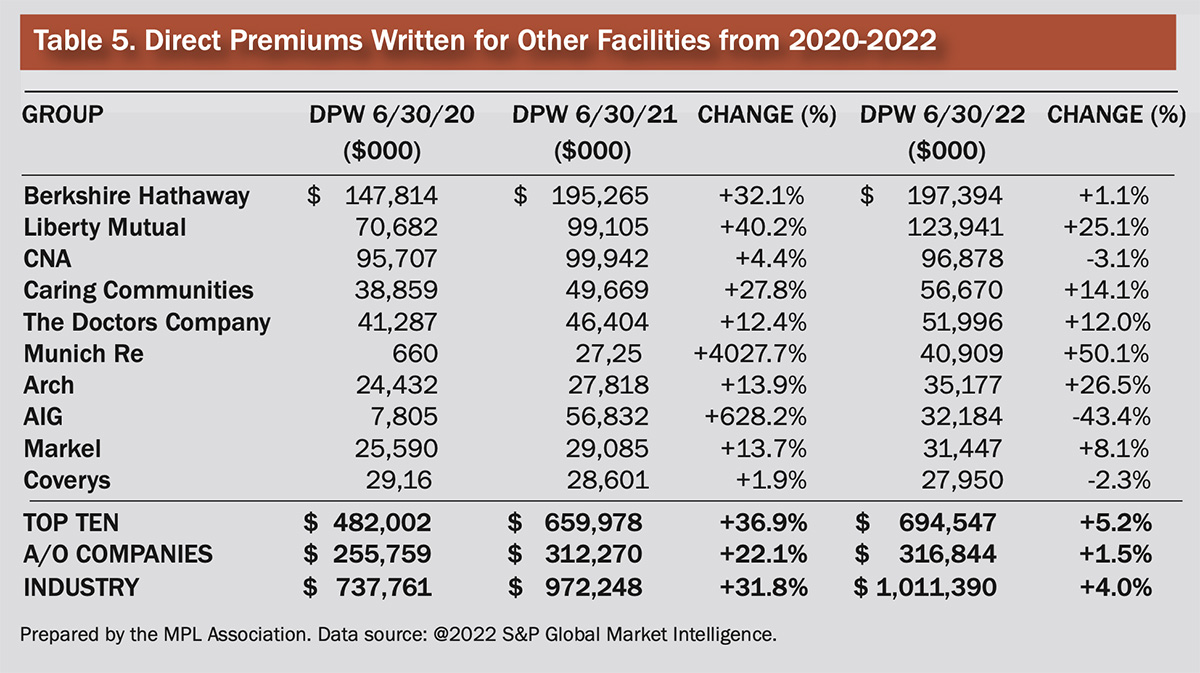

Other Facilities

The other facilities segment is dominated by commercial insurers: #1 Berkshire Hathaway (19.5% market share); #2 Liberty Mutual (12.2%); and #3 CNA (9.6%). Due to the heterogeneous/high-risk nature of many of the risks that fall into this category, most of the top insurers write other facilities business through excess and surplus (i.e., non-admitted) subsidiaries. For example, Berkshire Hathaway writes the business on National Fire & Marine Insurance Company paper, while Liberty Mutual writes through Ironshore Specialty Insurance Company.

For the last several years, “other facilities” (including long-term care facilities) has been the fastest growing segment of the MPL market. In the first half of 2021, DPW for this segment increased 31.8% over the same period in 2020. However, in the first six months of 2022, year-over-year growth was only 4% (Table 5).

Table 5. Direct premiums written for other facilities from 2020-2022. Prepared by the MPL Association. Data source: @2022 S&P Global Market Intelligence.

Excess and surplus lines companies have more flexibility in pricing and coverages options than admitted companies. Given the firmer pricing conditions of the market for the last several years (especially in the long-term care market), and the exposure growth of non-hospital facilities, the sizable premium growth in 2021 was not unexpected. However, the drop-off in growth in the first six months of 2022 suggests that competition could be dampening price increases. Therefore, while price increases are expected to continue in 2023, they will likely be in line with those of 2022.

What might we expect in 2023?

The MPL industry has not generated an underwriting profit since 2013 and this trend is expected to continue in 2022 and 2023. Assuming loss reserve redundancies have largely dissipated, the industry will need to continue to raise prices to improve underwriting results. However, according to the latest rate survey from the Council of Insurance Agents & Brokers, the average price increase for MPL in the third quarter 2022 was 3.1%, down from 3.2% in the second quarter, and more than two percentage points below average price increases of 5.6% in 2021.

The most likely scenario is that the industry will stay the course and premium changes in 2023 will largely resemble those of 2022. The industry is well-capitalized, and competition remains strong both in the traditional and alternative markets. As such, raising prices too much for risks that can find coverage elsewhere could result in a loss of business that is unlikely to be recouped.